By: Carter Crowley. Owner of Century Investment Group, LLC

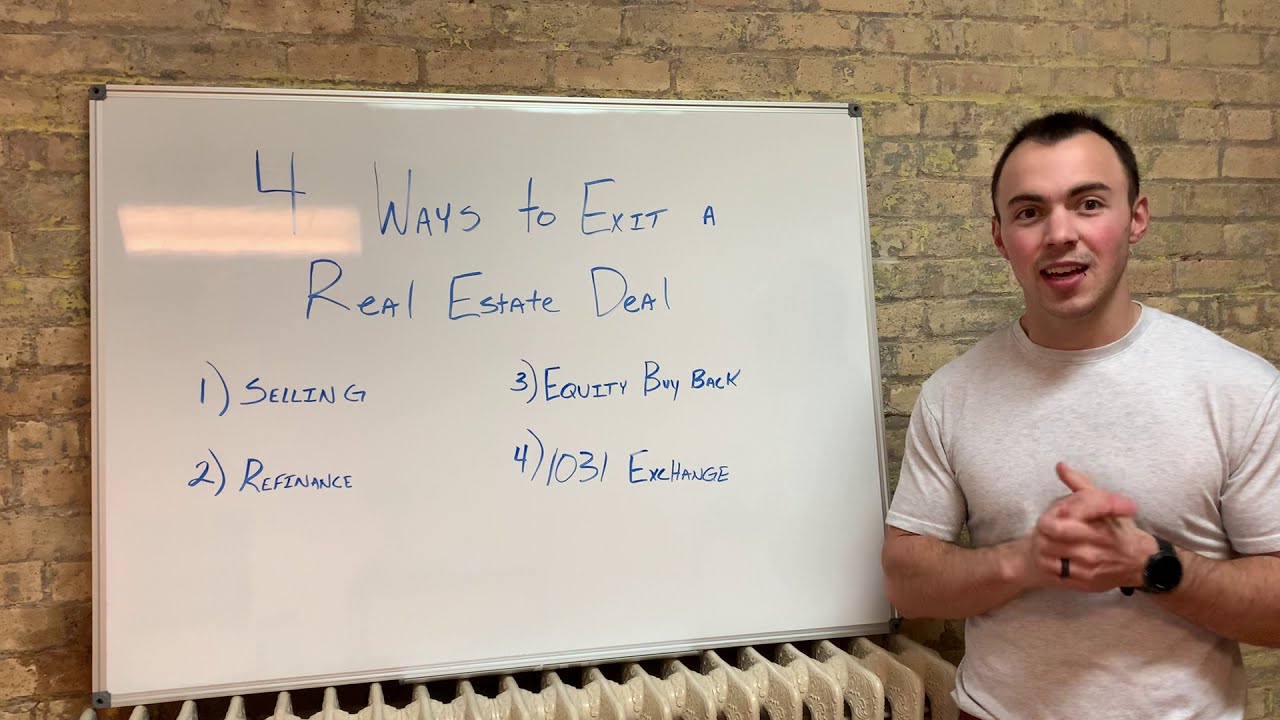

Do you want out of a real estate deal? Well, what options do you have? In this blog, I go over a few strategies you can use to successfully exit a real estate deal, and I even will throw in 2 bonus ways that few people talk about.

Process of Selling Commercial Real Estate

The first way to exit a piece of property is through a successful sale. Whether you list it on the market or you sell it to another individual, selling the property will get you off a title and successfully transfer it to another individual. How involved in the sales process you may ask? It depends on how many owners are involved, the current tenant situation, and if you want to take it to market or not.

Like everything, if you want a premium price it will force you to wait a little bit longer in order to make it happen. A premium price normally comes at the cost of waiting for the “right buyer”. A buyer who can earn a less than average ROI and still justify the purchase.

Be careful if you are selling a property and someone makes an offer which sounds too good to be true. In situations like this, we have encountered the buyer trying to renegotiate on price after the fact! The last thing you want to happen is be 45 days into escrow and then the transaction falls apart because the buyer tries to renogitate.

Refinancing Commercial Real Estate

Way number two is via a refinance. You might be familiar with refinancing in the single family space on your own personal residence. What happens during a refinance is you pull equity out of the property, or refinance to a lower interest rate & lower loan to value. Sometimes individuals have to refinance in order to remove someone from title.

We use a refinance to pay our investors or ourselves back the initial upfront investment into the deal. However, we only refinance AFTER we have significantly raised the value enough to justify this. Our new numbers after a refinance will still have to be cash flow positive and producing a healthy return.

Example Deal:

Initial Purchase Price: $1,200,000

Initial Down payment: $300,000

Capital Expenditures or Property Improvements Made: $115,000

Refinance Property Price: $1,800,000

Refinanced Loan Value: $1,350,000

We would distribute back all the initial upfront downpayment from purchase and all the money spent on improvements and capital expenses. While still having $35,000 in excess which we would split with our investors.

Equity Buy-Back From Passive Investors

All though this is not too common, passive investors in a real estate deal might have the option to sell back their equity to other individuals in the deal. However, real estate is an illiquid investment. Meaning, if you need 50 or a hundred thousand dollars you invested in a deal, you cannot get that for five to seven years from now, or until a successful exit from the deal pays you back. However, in certain situations, you can get the initial investment back and that would be the route of an equity buyback.

What this means is you would go to the individual operator, or other investors in the deal, to see if they would be interested in purchasing your equity stake in the deal. We will say your initial investment was a hundred thousand. Maybe you would be interested in getting out of the deal if they paid you a hundred thousand for that share of the property.

They may or may not be interested, it really depends upon what’s agreed upon upfront. But again, speak with an attorney or your local CPA to discuss this in further detail.

1031 Exchange in Commercial Real Estate

A 1031 exchange is a segment of the United States tax code which allows you to defer the capital gains tax to a later date, if you purchase a “like-kind” property.

An example being…

We sold a 20 unit apartment complex for a $450,000 profit. Instead of having 30-40% of the $450,000 going to the IRS, a 1031 Exchange would give us the ability to roll this profit into another property. Thus deferring the taxes to another day.

A 1031 Exchange does involve needing to sell the property and that would be the “exit-strategy” behind the deal. Real estate has many variables at play. If partnered with the right team, these can be utilized to the fullest extent!

BONUS: Seller Financed Commercial Real Estate

Seller financing is exactly what is sounds like. As the seller you will hold back some or all of the loan amount & have the property as collateral. When you sell a property via seller financing it is advantageous because it allows you to utilize the “gain” or “profit” over several years instead of just 1 lump sum payment. And, you are also earning interest on money which would just be sitting in the bank.

Seller financing can be a great way to exit out of a deal & this is why we utilize it when it comes to difficult property. It can also be very lucrative to come up with loan terms which would be in favor of you the current owner.

Want to Talk More?

Real estate is an amazing asset to have in your investment portfolio to not only diversify things but to also learn along the way! I feel it is vital to help passive real estate investors understand every nuance of the transaction so if they ever decide to do it on their own they are informed.

If you would like to discuss further about how we can partner on future deals please fill out the form below to schedule a call.

My Best,

Carter

*Schedule a Call* – Invest With Us

We would love to connect with you! If you are interested in investing passively in real estate please fill out the form below & you will receive an email with a link to Carter’s calendar to schedule a call.